New + updated

The 12 Best Snowboard Brands of 2024

March 4th

The holiday season is a time when we’re all tempted to spend too much. Whether we’re buying gifts for our loved ones or treating ourselves to a little something, it’s easy to get caught up in the spirit of giving and exceeding our budgets.

Want to avoid that this year? You’ve come to the right place. In this blog post, you’ll discover multiple tips and tools to help keep your impulse buying in check this holiday season. Using these tools, you can stay on budget, stick to your gift list, and avoid holiday debt!

Let’s get into it!

Related: Impulsive Buyers’ Guide To Slow Shopping

What Causes Impulse Buying?

Source: Pexels

To solve the problem, we must first understand the problem. In a nutshell, here are a few reasons that can cause you to indulge in impulse buying:

- Emotionality: When people are experiencing emotions such as anger, boredom, guilt, stress, or depression, they are more likely to make a purchase. Good moods and excitement can also cause people to buy things, as well as fatigue after a long day.

- Loss aversion: Our brain can often be tricked into thinking something is a good deal just because it’s on sale. So next time you see a sign for a discount, think twice before you buy!

- Biased evaluation: We are very optimistic people. No matter what, we believe that we’ll eat all the food we buy, wear every item of clothing, and use all the household items we pick up. The first step in the “How to avoid impulse buying” guide is to be realistic!

- Strategic product placement: Retailers often attract customers and encourage impulsive purchases. by putting on eye-catching window displays, placing lower-priced impulse items near the checkout, and offering samples & demos.

- The allure of novelty: We all love discovering something new and exciting. Research suggests that impulse buyers are often on the lookout for unique items. They get a rush of positive feelings when they stumble upon something new, making them more likely to buy it immediately.

- Fear of missing out (FOMO): FOMO is the nagging feeling that you’ll regret not snagging that limited-time deal or trendy item. This fear can override your logical thinking and push you into making impulsive purchases you later regret. We’ve all been there!

Examples of impulse buying include:

- Checkout counter items like candy & magazines

- Fast food & takeout

- Time-limited deals or promotions, like “buy one, get one free for the next hour”

- “Treat yourself”buys

- Snacks & junk food

- Clothes & accessories

Related: Don’t Regret A Purchase Ever Again With This Guide on How To Avoid Buyer’s Remorse

How to Stop Impulse Buying: 11 Great Tips

Check out 11 tips that will help you stop impulse buying this year.

1. Have a clear budget

Make a budget and go over it after you finish shopping for everyone on your list – including yourself. Having a budget you can stick to will help stop you from buying those cute but totally unnecessary boots on sale.

Another tip is to create a savings fund for something you really want that’s a bit pricey. So every time you feel the urge to buy something you don’t need, put that amount of money into the fund instead.

Related: Best Tips For Budgeting

2. Wait it out

Source: Unsplash

You can deter impulse purchases by giving yourself time to think about any purchase over a certain amount, like $50 or $100. A good rule of thumb is to give yourself at least 24 hours to decide if buying something is a need or just an impulse purchase by sleeping on it.

That way, your impulse has time to settle down, and you can approach the purchase with a clear mind if you really do need it. You can revisit the item after your waiting period has expired and even use the information to do comparison shopping online.

3. Ignore promotional emails and ads

Source: Promo advertisement

Besides not having lists and emotional triggers, what else contributes to impulse shopping? Exposure to social media and endless deals in your inbox is partly to blame.

Nowadays, social media is more focused on product placement and influencing people than it is on connecting with friends.

Even if your only intention is to see how your loved ones are doing, you’ll be bombarded with ads. It’s the same story with those tempting emails promising massive savings and unbeatable deals – try to limit how many email lists you subscribe to.

Start clicking that unsubscribe button and get rid of all that digital clutter.

4. Check out the reviews!

The next time you’re thinking about buying something, read its product reviews – especially the bad ones.

A lot of the time, bad reviews are just people exaggerating, but sometimes they show you the ugly truth about a product that’ll make you realize it’s not worth buying.

Scrolling through the reviews of people who have bought the item before you can save you a ton of money. You should always read the reviews of an item online, especially if you’re not sure if it lives up to its hype.

The reviews can tell you if customers are satisfied, upset, or just meh about their (impulse) purchases.

Related: How To Spot Fake Product Reviews?

5. Make it harder to shop

One effective way to curb impulse buying is to physically make it more difficult for yourself to shop impulsively. This means removing easy access to online shopping apps or disabling one-click purchasing options.

For physical stores, leave your credit cards and extra cash at home. Use cash or a debit card with a strict budget when shopping in person. By creating these obstacles, you’ll give yourself ample time to think before making a purchase.

Related: Pick Your Poison: Pros and Cons of Buy Now, Pay Later vs Credit Cards

6. Keep yourself busy

Source: Unsplash

When you feel the urge to shop impulsively, distract yourself with an activity you enjoy or that requires your full attention.

This could be reading a book, going for a walk, or engaging in a hobby. Redirecting your focus will help you shift your thoughts away from shopping and reduce the impulse to buy.

7. Give yourself permission to spend

This sounds counterintuitive, we know. But, allowing yourself to spend money can help prevent impulsive purchases. Set aside a specific budget for discretionary spending each month.

Since this money is meant for non-essential purchases, you won’t have to feel guilty about buying something you want. Knowing you have this budget can reduce the urgency of impulsive buying.

8. Keep your financial goals in mind

Try as much as possible to remember your long-term financial goals and priorities. Whether it’s saving for a vacation, paying off debt, or building an emergency fund, keeping these objectives in mind can deter impulsive buying.

So, before you make a spontaneous purchase, ask yourself if it aligns with your overall financial plan.

9. Shop with a list

Source: Unsplash

Before you go shopping, make a detailed list of the items you need. Be specific about quantities and brands if necessary.

Stick to this list as closely as possible, and avoid deviating from it unless you have a compelling reason. This list serves as a reminder of your actual needs and may help you resist the temptation of impulse buying.

Related: Household Supplies Checklist: Everything You Need For A Well-Stocked Home

10. Go on a no-spend challenge

A no-spend challenge is a commitment to limit your spending to essential expenses for a set period. During this time, you’ll focus on covering necessities like rent, utilities, and groceries while avoiding nonessential purchases.

This challenge will help you prioritize responsible spending, break impulsive buying habits, and redirect money toward your financial goals.

11. Remove your saved card information

To make online shopping less convenient, remove your saved card information from websites and apps.

This extra step of entering your payment details can act as a deterrent to impulse buying, as it gives you a moment to reconsider whether the purchase is worth the effort and money.

4 Tools to Help Curb Impulse Buying

Here are 4 great tools that’ll help you on your journey to curbing impulse buying this holiday season.

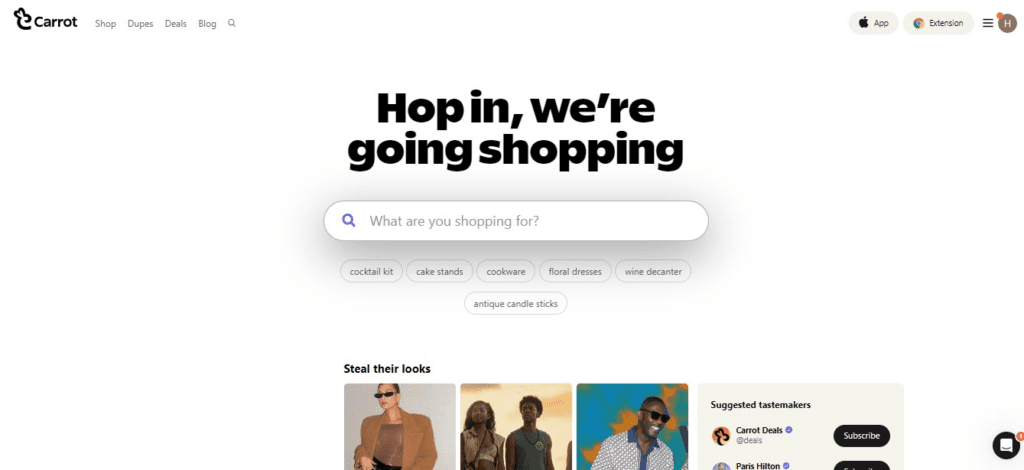

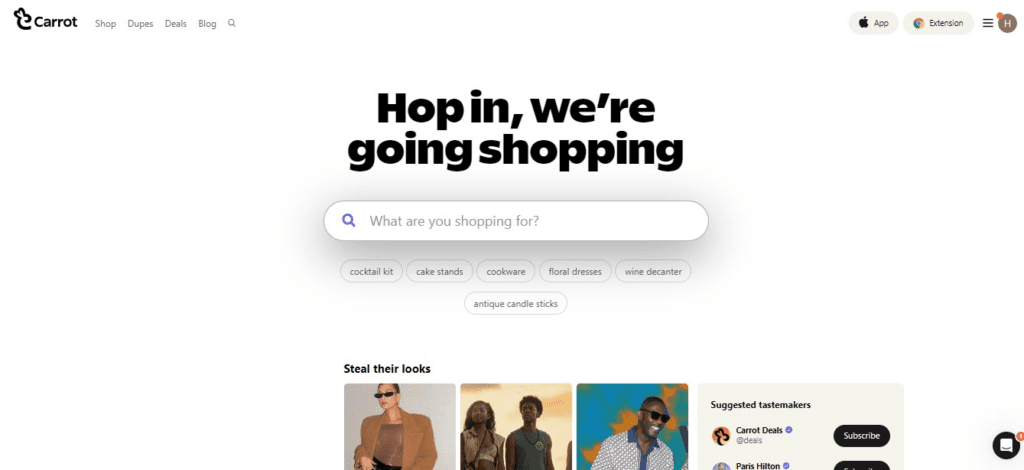

1. Carrot

Source: Carrot

Carrot is a free Google Chrome extension and iOS app that automatically collects your carts as you shop. This means that whatever you ‘add to cart’ on any online store gets automatically saved on Carrot as a list that you can organize and share.

Here’s how Carrot can help you curb impulse buying:

Organize your shopping: With this tool, you can create holiday shopping lists & collections to keep track of your shopping. This handy feature keeps you focused on what you really need or want to buy, preventing you from making impulse buys.

Compare prices: Carrot helps you compare items on quality, sizing, and reviews to avoid making a shopping decision you’ll regret!

Track prices: You can receive price drop alerts on any item to get the best deals & save more money.

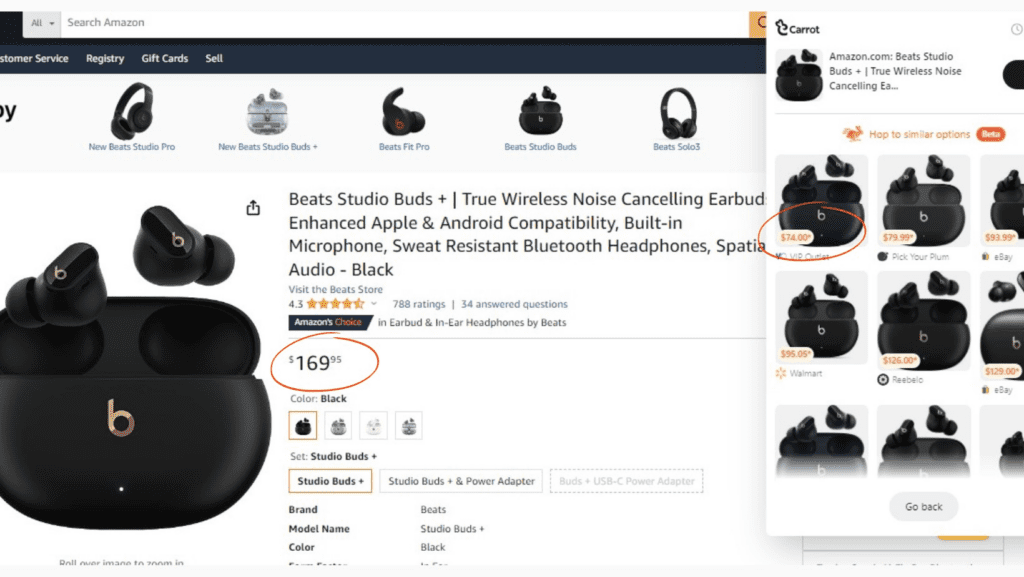

Find cheaper products: Carrot’s AI-powered Deal Hop feature lets you discover cheaper alternatives for any product (you can find deals of up to 90% off!) This allows you to see other products that meet your needs so you can make thoughtful shopping choices.

Using Carrot’s Deal Hop feature on Amazon

Related: The Ultimate Guide on How To Use Carrot

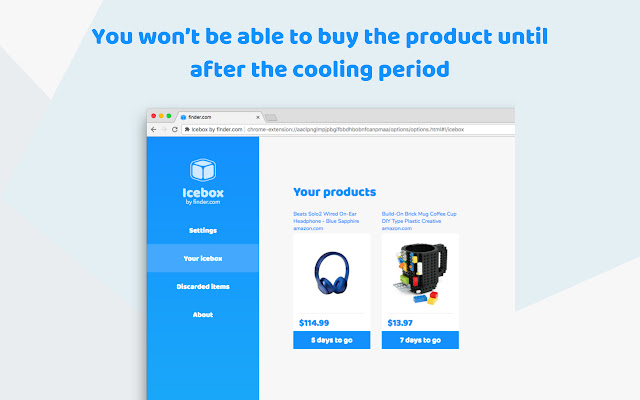

2. Icebox

Source: Icebox Chrome Web Store

Icebox is a free Google Chrome plug-in that replaces the buy button on over 500 retail websites. Instead of buying items, users can put items “on ice” for three to 30 days as they think through their purchase.

People won’t be blocked from making a purchase. You can override the system if it’s something you really need to buy. The idea is to get you to think harder about your purchases – but we doubt having an “unfreeze” option will truly help prevent impulse buying.

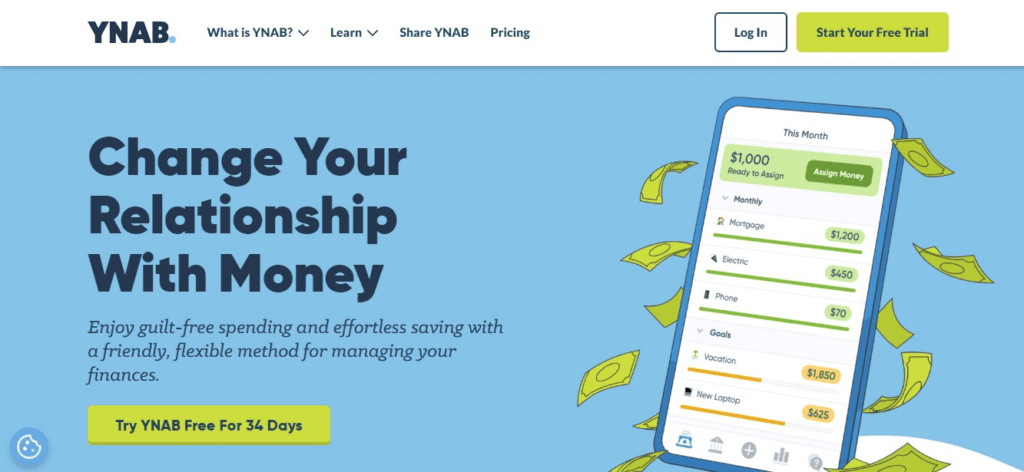

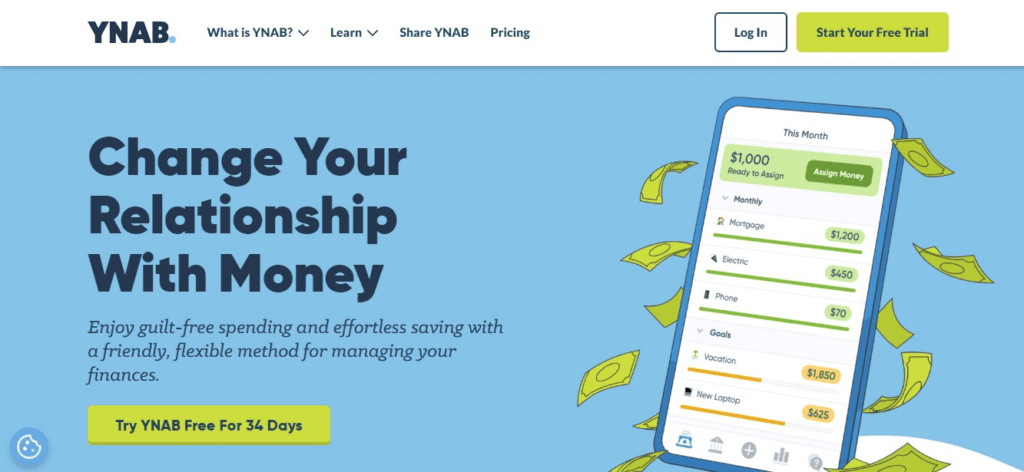

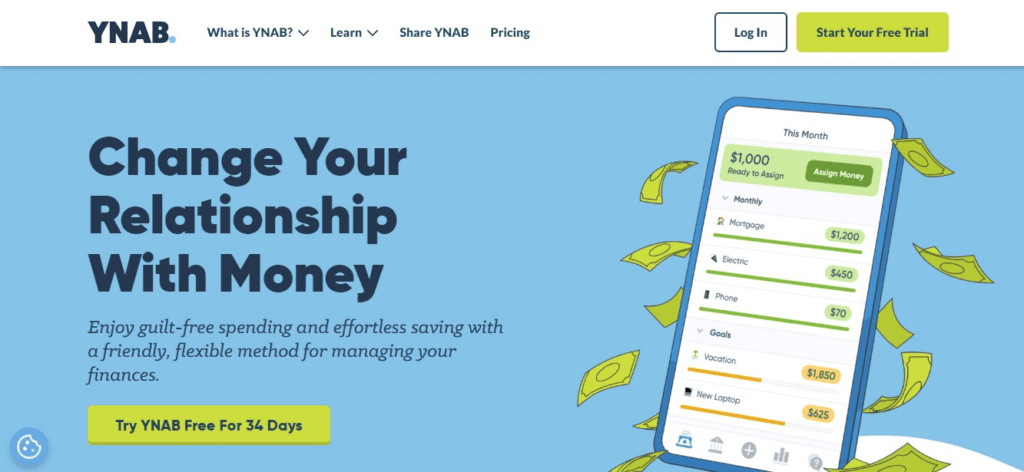

3. YNAB

Source: YNAB

YNAB, or You Need A Budget, encourages you to plan ahead for purchases that genuinely bring you happiness.

Instead of cutting back on spontaneous purchases, YNAB encourages you to create a budget category for “occasional indulgences” or “little treats” where you allocate funds monthly.

By doing so, this tool ensures that small-scale spending won’t catch you off guard and hinder your bigger financial goals.

4. BlockSite Brower Extension

Source: BlockSite

A browser extension like BlockSite allows you to stay more focused and in control of your online activities.

Its custom blocklists let you add specific websites to your block list, ensuring that you won’t be tempted by online shopping sites that trigger impulse buying.

Make Mindful Spending Choices With Carrot

Impulse buying doesn’t have to be a holiday tradition. Armed with our practical tips and a powerful shopping companion like Carrot, you can break free from the cycle of overspending and make every purchase a deliberate choice.

With Carrot, you can shop mindfully, stay within your budget, find deals up to 90% off, and save BIG.

The best part? It’s absolutely free!

Say Goodbye to Impulse Purchases, Only With Carrot🥕

This shopping extension lets you keep track of your shopping, compare prices, stop impulse buying, find cheaper products, and create wishlists & gift registries.

What are you waiting for?